Bitcoin mining farm. Photo: Marko Ahtisaari

The first transaction involving the use of a crypto currency to buy something physical was on May 22nd, 2010 when 10,000 bitcoins were exchanged for two pizzas in Florida. Since then you have to have been living in a cave not to have heard of Bitcoin and other crypto currencies. But most people have little understanding of just what this is all about.

So what is a crypto currency? Wikipedia defines it as ‘a digital asset that uses cryptography to control its creation and management rather than a central authority’. This, I think, is a rather cryptic description in itself and does not refer to an underlying key technology, blockchain[1], without which none of this would exist. But I digress.

Because there is no central authority like a bank or government to regulate cryptocurrencies there are some advantages and some disadvantages; no transaction fees, it’s available to everyone and transactions like sending money across national borders are simpler. However, while transactions are tracked, the people making them are anonymous so tax evaders, criminals, and terrorists can also use cryptocurrencies for their own undesirable purposes.

I’d also bring you back to the definition above. Note the use of the term “asset”.

Most of us would expect an ‘asset’ to have some physical properties (such as gold or a Dutch tulip farm) or at the very least a commitment from a respected financial institution (such as a solvent country’s central bank) to exchange your asset thingy for readily exchangeable currency. If not, your asset must provide something valued by a large number of people (such as an ‘old master’ painting).

Because there is no underlying commitment from anyone to pay you for your crypto or a physical asset on which to base the value (e.g gold), crypto currencies rely on something that has been described as the ‘greater fool’ theory to create value. You value your thingy because you expect a greater fool to take your thingy off your hands in return for something of exchangeable value. Bernie Madoff and other Pyramid schemes come to mind that rely on a network of ‘greater fools’.

Here’s the rub; in the end the quoted value of a crypto currency is driven by the number of greater fools willing to buy versus the number willing to sell. Nothing more, nothing less. And yet, despite its lack of a basis for valuation, undeniably crypto currencies seem to be here to stay, perhaps because the world is full of greater fools and gamblers. But that’s just my opinion.

I have had financial advisors contact me about ‘investing’ in crypto currencies. I avoid them like the plague because you cannot invest in anything that has no basis for valuation other than the irrational hopes and fears of speculators. You can speculate or gamble. But that is not investing.

Which brings me to the recent implosion of FTX which was launched in 2019 by Sam Bankman-Fried (below) who grew it into one of the leading exchanges for buying and selling crypto derivatives. At it’s fevered height, investors (or more accurately gamblers) valued FTX and its U.S. operations at a combined $40 billion.

The penny started dropping late 2022. Users began withdrawing their money from FTX. This was exacerbated when blockchain watchers spotted hundreds of millions of dollars had been moved out of FTX ‘cryptocurrency wallets’ by management. In November, FTX was forced to file for bankruptcy. In December, Bankman-Fried was indicted on multiple criminal fraud charges, the prosecutor calling his actions “one of the biggest financial frauds” in American history.

The case is still in process but it would appear that there was unbridled and uncontrolled manipulation of everything and anything. How such unqualified and unprincipled people nominally running FTX and its companies could have been appointed by the Board and left to run free blows my mind. It was like dropping a bunch of school kids into a sweet shop and letting them run riot.

FTX’s investors and consumers almost certainly will not recover the billions of dollars lost in FTX’s collapse and FTX and Bankman-Fried will be the targets of many future lawsuits and bankruptcy proceedings. The huge losses, allegations of fraud and the attempted cover-up of severe financial troubles will likely lead to a severe prison sentence.

Not unexpectedly there is more. I won’t bore you with an enumeration but I’ll refer you to an article if you’re interested that is headlined ‘Top Ten Blockchain Scandals’ which covers, amongst others, Mt. Gox, The Bitcoin Savings & Trust and the MyCoin Pyramid scheme. See: https://www.planetcompliance.com/top-10-scandals-rocked-blockchain-world/

Additionally, in an age where climate change is becoming an existential threat to the world it would be remiss of me not to finish with the following[2]:

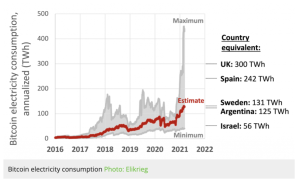

In 2021, Cambridge University estimated that Bitcoin alone consumed more energy than Argentina. As of August 2022, estimates of the total crypto related global electricity usage exceeded the total annual electricity usage of many individual countries, such as my home country, Australia. This is equivalent to 0.4% to 0.9% of annual global electricity usage.

Nearly all crypto electricity usage is driven by computers mining and verifying crypto-coins (as of August 2022, Bitcoin is estimated to account for 60% to 77% of total global crypto-asset electricity usage and Ethereum 20% to 39%). And this is increasing at an alarming rate. It is energy consumption that is not producing anything of value.

And, despite talk about making this whole process more efficient, “Bitcoin is literally anti-efficient,” as David Gerard, author of Attack of the 50 Foot Blockchain stated. “So more efficient mining hardware won’t help – it’ll just be competing against other efficient mining hardware. This means that Bitcoin’s energy use, and hence its CO2 production, only spirals outwards. It’s very bad that all this energy is being literally wasted in a lottery.”

There’s a lot more that could be written and discussed about this technology, a technology that is eating up resources and misappropriating billions of dollars in what are fundamentally scams.

Al I can do is echo that oft-used Latin phrase, ‘Caveat Emptor’ – buyer beware – and hope that you, my reader, don’t fall prey to the dark side.

[1] A blockchain is a distributed digital ledger consisting of records called blocks that are used to record transactions across many computers so that any created record or block cannot be altered retroactively, without altering all subsequent blocks. This allows participants to independently verify and audit transactions. The key element is that a blockchain does not require a central controller (like a central bank) but instead is self-validating because transactions cannot be eliminated or changed once booked.

[2] Climate and Energy Implications of Crypto-Assets in the United States: White House publication